Dear Coreto Community,

We could not be more excited and grateful for the success of our initial Staking Reward program, where all of the three pools closed successfully in record time.

To answer the community’s needs and in expectation of our Alpha release in Q1 2021, we’re adding two additional staking pools:

- One Traditional Staking Pool — 180 days, 48% APR

- One Liquidity Staking Pool — 60 days, 110% APY

To keep the process moving, we prepared this helpful guide to understand the benefits of each new Pool and how they will work.

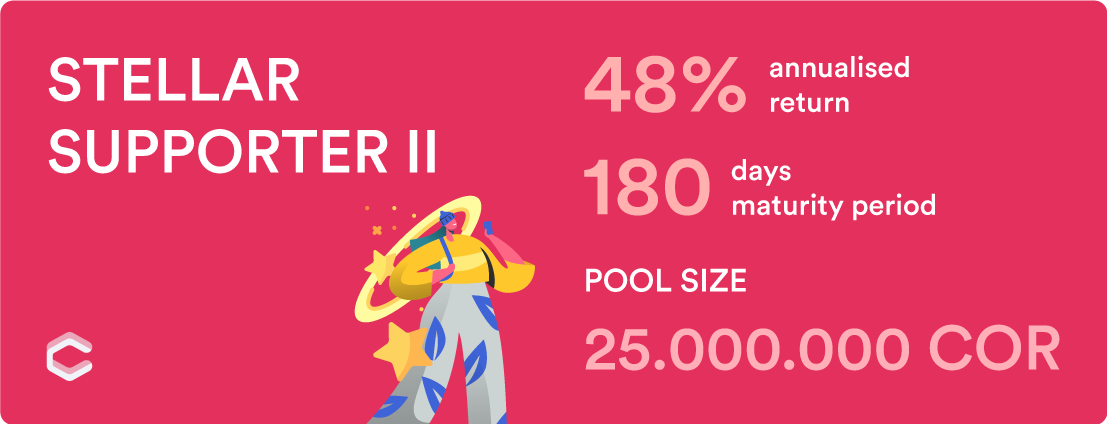

Traditional Staking Pool — Stellar Supporter II

The initial Stellar Supporter Pool was the most popular and based on our community’s vote, we’re opening another one, with the same APR and maturity period, but we’ve made a few adjustments:

- Pool cap was increased to 25,000,000 COR

- Minimum contribution is raised to 250,000 COR

- Maximum contribution per address was added to 3,000,000 COR

If any participants decide to withdraw early, their forfeited rewards will be evenly distributed amongst the users that will stake until the pool matures.

A Staking Guide was previously published, so you can use it for reference in case you need it.

Liquidity Staking Pool

- Rewards: Uniswap Trading Fees + 110% APY

- Full maturity: 60 days

- Early withdrawal: after 30 days

- Early withdrawal rewards start at 40% APY + Trading Fees

- The time period to contribute: 8 days

Most people are already familiar with the concept of Staking Tokens and adding Liquidity to Uniswap pools. We’re merging the two features into one, giving you an additional incentive for adding liquidity to Coreto’s Uniswap COR/ETH Pool.

How does it work?

The concept is pretty straight-forward:

- User adds liquidity to the COR/ETH Pool on Uniswap

- User receives UNI-V2 COR-ETH pool tokens from Uniswap

- User stakes the aforementioned UNI-V2 tokens in our Liquidity Staking Pool

- At the time of withdrawal, the user receives the staked UNI-V2 tokens + the rewards in COR with an APY of 110%.

The term “APY” (Annual Percentage Yield) indicates the rewards that you would receive for a staking duration of one complete year. Since the pool staking periods are all factors of 360 days we have chosen to use 360 days as the complete APY period rather than 365 days. By taking this approach, it simplifies things and makes them more understandable. The bonus is that this equates to slightly higher rewards earned.

Right now, adding 1 ETH and 1,392,000 COR to Uniswap’s ETH/COR pool gives you roughly 1,130 UNI-V2 tokens.

As a simple example, staking 1,130 UNI-V2 tokens in our Liquidity Staking Pool will provide you with 255,200 COR at the end of the period which equals to 110% APY.

Here is a quick guide on How to add Liquidity to the COR-ETH Uniswap pool.